UPI Safety Guide: How to Stay Secure While Using Digital Payments in India (2025)

Digital transactions have become an integral part of daily life in India, with UPI (Unified Payments Interface) leading the transformation. Launched by the National Payments Corporation of India (NPCI), UPI allows real-time money transfers through smartphones using just a UPI ID or registered mobile number. It has made banking accessible and seamless for millions of Indians, from urban centres to rural areas.

However, with growing usage comes growing risks. Cybercriminals are continuously devising new ways to exploit unsuspecting users. That’s why understanding UPI safety is essential for everyone—from tech-savvy users to first-time digital payment users.

This comprehensive UPI Safety Guide will help you recognize common scams, follow essential security tips, and know what steps to take if you become a victim of fraud.

What is UPI?

Unified Payments Interface (UPI) is a revolutionary instant payment system that enables secure money transfers between bank accounts using a mobile phone. Developed by NPCI, it allows users to:

- Transfer money 24/7, even on holidays

- Pay using UPI IDs, mobile numbers or QR codes

- Use multiple bank accounts in one app

- Make payments without entering account details

Popular UPI apps include Google Pay, PhonePe, Paytm, BHIM, Amazon Pay, and mobile banking apps like SBI YONO, BOB WORLD, HDFC PayZapp, and ICICI iMobile.

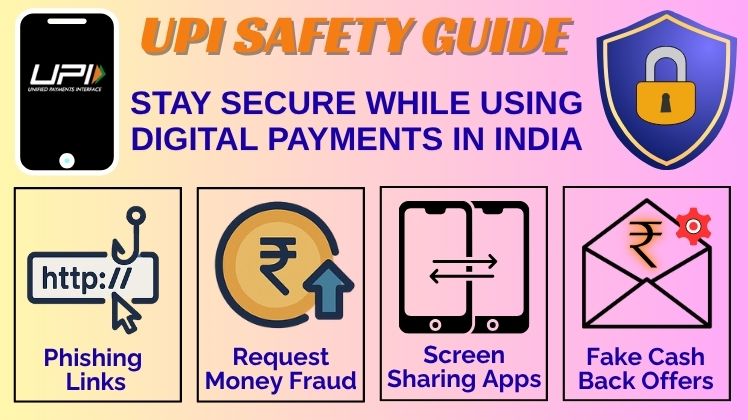

Common UPI Scams in India to Watch Out For

As the adoption of digital payments increases, so do attempts at fraud. Here are some of the most common UPI scams in India:

1. Phishing Links

Cybercriminals often send fake emails, SMS, or WhatsApp messages with links that appear to be from trusted sources. Clicking these links can lead to fake websites asking for your UPI credentials or PIN.

2. Fake ‘Collect Money’ Requests

Scammers may pretend to send you money and instead send a collect request, hoping you will accidentally approve it. Remember, approving a request means you’re sending money—not receiving it.

3. Fraudulent Customer Care Numbers

Many people search for customer care online. Fraudsters list fake numbers, pretend to be support agents, and ask for your UPI PIN or OTP. Always use official websites or in-app support.

4. Screen Sharing Apps

Apps like Any Desk, TeamViewer, and Quick Support can allow fraudsters to remotely control your phone. They may ask you to install them under the pretext of helping with issues but use them to steal sensitive information.

5. Fake Cashback or Reward Offers

Messages promising cashback or free rewards often include malicious links that install malware or redirect to fraudulent payment forms.

UPI Safety Tips Everyone Should Follow

Digital safety starts with awareness. Here are key UPI safety tips to follow before, during, and after making transactions:

Before Making a Transaction

✅ Verify UPI ID and Recipient Name: Double-check the UPI ID or mobile number of the recipient before transferring money.

✅ Download Only from Official App Stores: Install UPI apps like Google Pay or PhonePe only from the Google Play Store or Apple App Store.

✅ Enable App Locks: Use biometric locks (fingerprint/Face ID) or passcodes to protect access to your UPI app.

✅ Use Strong Passwords: Secure your device and apps with strong, unique passwords.

While Using the App

✅ Check SMS Alerts: Monitor your SMS notifications for each transaction to detect unauthorized payments instantly.

✅ Set Transaction Limits: Reduce the risk of large-scale fraud by setting daily or per-transaction limits.

✅ Use Verified Support Channels: Contact your bank or UPI app using official customer care numbers or in-app support only.

✅ Log Out After Use: Always close or lock the app after completing transactions.

What You Should Never Do

❌ Never Share Your UPI PIN or OTP: No bank or app will ever ask for your UPI PIN or OTP. Keep it confidential.

❌ Don’t Click on Unverified Links or QR Codes: Avoid scanning unknown QR codes or clicking on suspicious links.

❌ Avoid Approving Unknown Requests: Don’t approve a collect request unless you are buying something from a trusted source.

❌ Don’t Download Apps from Third-Party Sites: Stick to verified app stores to avoid malicious apps.

What to Do If You're a Victim of UPI Fraud

If you suspect fraudulent activity or have fallen prey to a scam, take immediate action:

1). Contact Your Bank or UPI App Support

Use the app’s help/support feature or call the bank’s toll-free number to report unauthorized transactions.

2). File a Complaint at the National Cyber Crime Portal

Visit www.cybercrime.gov.in and lodge a detailed complaint under the ‘Report Other Cyber Crimes’ section.

3). Inform the Local Police or Cyber Cell

Filing an FIR at the nearest police station increases your chances of recovering funds.

4). Request Transaction Freeze

Ask your bank to temporarily freeze your account or reverse unauthorized transactions if possible.

Official UPI Apps in India

Use only these recognized and secure UPI apps for digital payments:

- BHIM UPI (by NPCI)

- Google Pay

- PhonePe

- Paytm

- Amazon Pay

- Official mobile banking apps (e.g., SBI YONO, iMobile by ICICI, HDFC Mobile Banking)

These apps follow RBI guidelines and offer in-app security features to keep your transactions safe.

UPI Safety Checklist: Dos and Don'ts

Here’s a quick comparison to keep handy while using UPI services:

✅ Safe Practices | ❌ Avoid These |

Use only official UPI apps | Clicking on unknown links or QR codes |

Set biometric or PIN lock | Sharing UPI PIN, OTP, or credentials |

Confirm UPI ID before sending | Approving unknown collect requests |

Monitor transaction alerts | Ignoring suspicious activity |

Report fraud immediately | Delaying complaint or action |

Final Thoughts: Digital Convenience with Digital Caution

UPI has made digital payments incredibly fast, accessible, and hassle-free. But with this convenience comes responsibility. Being aware of UPI frauds, recognizing red flags, and following safety guidelines can protect you from becoming a victim.

Remember the golden rule:

“Your UPI PIN is like your ATM PIN—Keep it Secret, Keep it Safe!”

Always stay updated with the latest digital safety tips and secure payment practices. Share this guide with your friends and family so that everyone can benefit from secure online transactions.